transforming classrooms

through world-class

financial literacy

transforming classrooms

through

world-class

financial literacy

The leading personal finance platform for schools

save time, boost student attendance, engagement, and test scores

let's find the right

personal finance curriculum for you

Empower your students with real-world financial skills.

Our K-12 customized programs align with educational standards, providing engaging lessons, interactive tools, assignments, test questions, and full teacher support to help students master money management from an early age.

Request a demo today, and one of our experts will connect with you to discuss details, showcase a demo, and guide you through the onboarding process.

- Engage Students

- Improve Attendance

- Customize Classes

A complete personal finance curriculum designed for homeschool families.

With flexible, customized, self-paced lessons and engaging activities, parents can confidently teach financial literacy at any grade level—no prior expertise required.

Request a demo today, and one of our experts will connect with you to discuss details, showcase a demo, and guide you through the onboarding process.

- Engage Students

- Customize Classes

- Plug & Play

Give your students a financial edge.

Our higher education programs cover everything from foundational money management to advanced financial strategies, equipping students with skills to manage debt, build credit, invest wisely, and achieve long-term success.

Request a demo today, and one of our experts will connect with you to discuss details, showcase a demo, and guide you through the onboarding process.

- Replace Textbooks

- Supplement Classrooms

- Support Professors

Donate the MMU finance curriculum to schools in your community.

As a sponsor, your contribution helps provide our comprehensive personal finance program at a discount or completely free to underserved schools, families, and individuals. It can also provide great branding and PR for your business.

Interested in giving back? Contact us today by filling out a form to learn more about sponsorship opportunities.

- Benefit Lore Ipsum 1

- Benefit Lore Ipsum 2

- Benefit Lore Ipsum 3

Empower your students with real-world financial skills.

Our K-12 customized programs align with educational standards, providing engaging lessons, interactive tools, assignments, test questions, and full teacher support to help students master money management from an early age.

Request a demo today, and one of our experts will connect with you to discuss details, showcase a demo, and guide you through the onboarding process.

- Engage Students

- Improve Attendance

- Customize Classes

A complete personal finance curriculum designed for homeschool families.

With flexible, customized, self-paced lessons and engaging activities, parents can confidently teach financial literacy at any grade level—no prior expertise required.

Request a demo today, and one of our experts will connect with you to discuss details, showcase a demo, and guide you through the onboarding process.

- Engage Students

- Customize Classes

- Plug & Play

Give your students a financial edge.

Our higher education programs cover everything from foundational money management to advanced financial strategies, equipping students with skills to manage debt, build credit, invest wisely, and achieve long-term success.

Request a demo today, and one of our experts will connect with you to discuss details, showcase a demo, and guide you through the onboarding process.

- Replace Textbooks

- Supplement Classrooms

- Support Professors

Donate the MMU finance curriculum to schools in your community.

As a sponsor, your contribution helps provide our comprehensive personal finance program at a discount or completely free to underserved schools, families, and individuals.

Interested in giving back? Contact us today by filling out a form to learn more about sponsorship opportunities.

- Benefit Lore Ipsum 1

- Benefit Lore Ipsum 2

- Benefit Lore Ipsum 3

global recognition

There’s good reason why we’ve been consistently recognized globally in the field of education and learning.

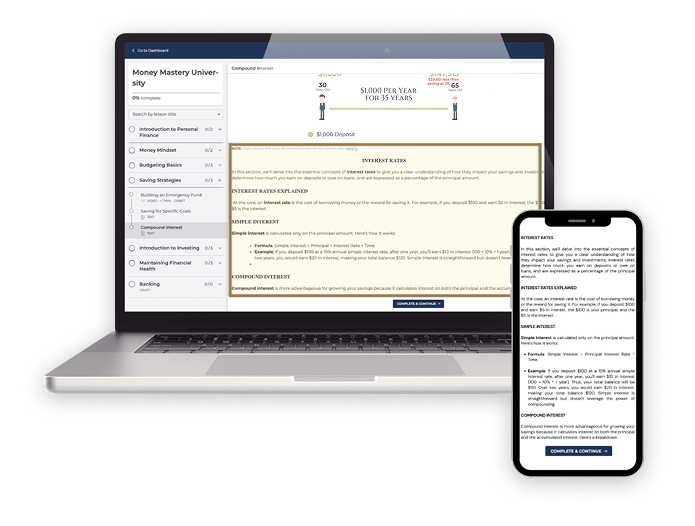

world class plug & play platform

Assign pre-built lessons, pre-made tests, and ready-to-use homework, track analytics, and communicate – all in one seamless platform.

Plug & Play

Our plug-and-play system gives schools, homeschools, and higher ed instant access to a world-class financial education platform—no complex setup, no lengthy training, just real-world financial knowledge, ready to go.

Teacher & Student

Interfaces

Intuitive, user-friendly dashboards designed for both educators and learners.

Communication

Made Easy

Built-in messaging and collaboration tools streamline interaction between teachers and students.

Real-time

Analytics

Track progress, performance, and engagement with instant data insights at a classroom level, school level, or district level.

Classroom

Management

Customize and organize lessons, assignments, tests, and student progress all in one place.

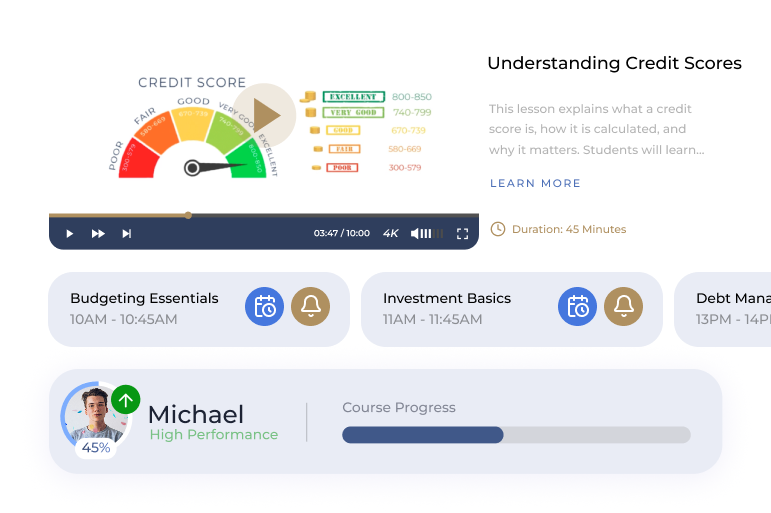

Understanding Credit Scores

This lesson explains what a credit score is, how it is calculated, and why it matters. Students will learn…

Learn More

- Duration: 45 Minutes

Budgeting Essential

This lesson explains what a credit score is, how it is calculated, and why it matters. Students will learn…

Learn More

- Duration: 45 Minutes

Investment Basic

This lesson explains what a credit score is, how it is calculated, and why it matters. Students will learn…

Learn More

- Duration: 45 Minutes

Understanding Credit Scores

- Assign

- Preview

Budgeting Essentials

- Assign

- Preview

Investment Basics

- Assign

- Preview

Plug & Play

Our plug-and-play system gives schools, homeschools, and higher ed instant access to a world-class financial education platform—no complex setup, no lengthy training, just real-world financial knowledge, ready to go.

Teacher & Student

Interfaces

Intuitive, user-friendly dashboards designed for both educators and learners.

Communication

Made Easy

Built-in messaging and collaboration tools streamline interaction between teachers and students.

Real-time

Analytics

Track progress, performance, and engagement with instant data insights at a classroom level, school level, or district level.

Classroom

Management

Customize and organize lessons, assignments, tests, and student progress all in one place.

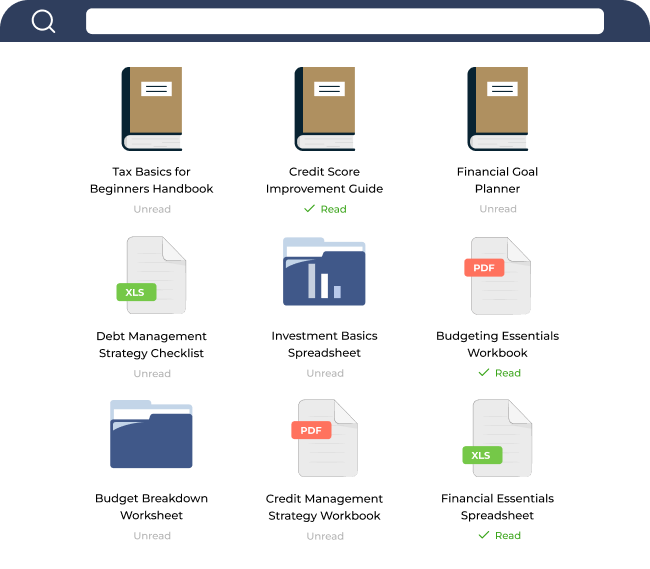

everything you need

Lessons are packed with provided resource guides, assignments, test questions, and more to save teachers time and energy.

what's provided

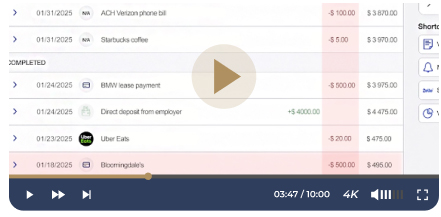

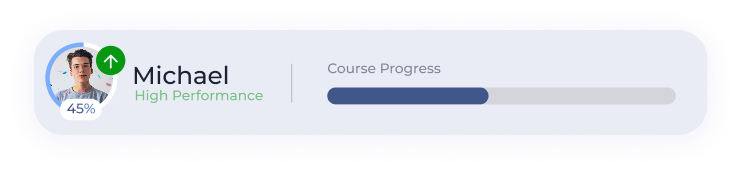

4K Engaging Videos

Engaging, expert taught, high-resolution educational videos that break down complex financial concepts into easy-to-understand, real-world applications. These videos go beyond the basics, incorporating equations, step-by-step math walkthroughs, and deep dives into key concepts—ensuring students stay captivated and eager to learn, with more than just a talking head on screen.

Supportive Text

Comprehensive written content accompanies every lesson, reinforcing key lessons, providing deeper explanations, and ensuring students fully grasp important financial principles.

Guides & Worksheets

Concise yet detailed guides serve as quick-study resources, offering students and teachers easy access to key concepts, formulas, and real-world examples whenever they need a refresher.

Homework & Projects

Professionally crafted exercises and projects that help students apply what they’ve learned through critical thinking and real-world financial decision-making.

Teachers can save hours of prep time by choosing from our ready-made assignments or easily customizing them to fit their classroom needs — giving them full control without the workload.

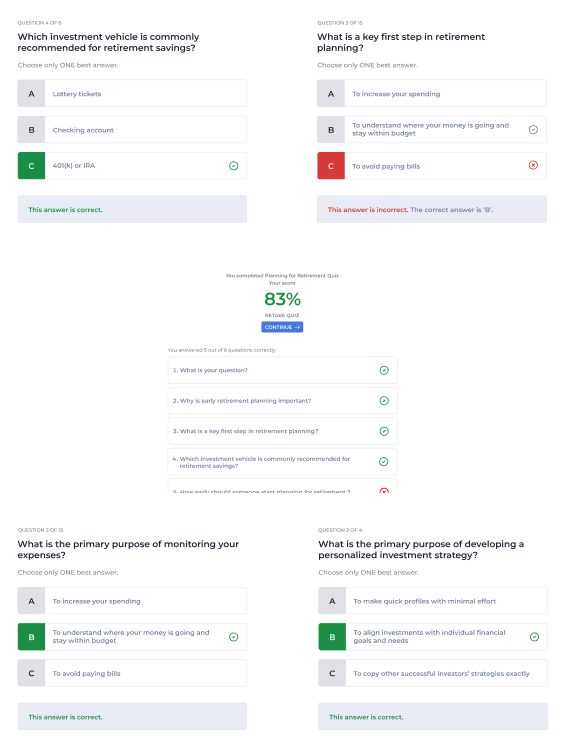

Test Questions

Thousands of pre-built questions — including multiple choice, single option, and more — allow teachers to easily create quizzes, tests, and assessments without starting from scratch.

Educators can select from our professionally designed question bank, customize them, or add their own, making it effortless to measure comprehension, track progress, and gain valuable insights into student learning.

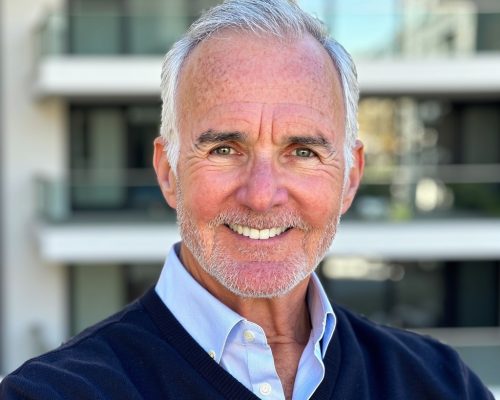

expert led content

Taught and backed by industry experts, the content provided covers everything from banking basics, credit, budgeting, and interest rates to

money management, investing, buying property, tax strategy, and more.

beyond financial literacy

math, reading, and tech skills while aligning with educational standards.

Mathematics Standards

Our programs integrate real-world financial scenarios to reinforce key mathematical concepts, helping students improve their math abilities and boost test scores. We guide students through the math behind financial decisions with step-by-step explanations, real-life examples, and hands-on assignments to ensure understanding.

This approach—combining problem-solving, practical application, and quiz-based assessments helps students develop stronger mathematical skills, supporting their overall academic growth.

Mathematics

Standards

Plaid whatever umami gentrify

Kinfolk hexagon slow-carb lumbersexual microdosing art shabby salvia diy. Marfa next taiyaki cred hipster kale bespoke cloud. Fit narwhal tacos vibecession artisan pug goth beard.

testimonials

Holly H.

Student

H

Paul

Student

P

Joshua R.

Student

J

Wolfgang F.

Student

W

Carolina F

Student

C

Kelvin Jewel M.

Student

K

Brandee M.

Student

B

Jayce Promise E.

Student

J