PLUG & PLAY LESSONS

FROM BASICS TO ADVANCED

Choose from our catalog or make a custom request – we’re always building.

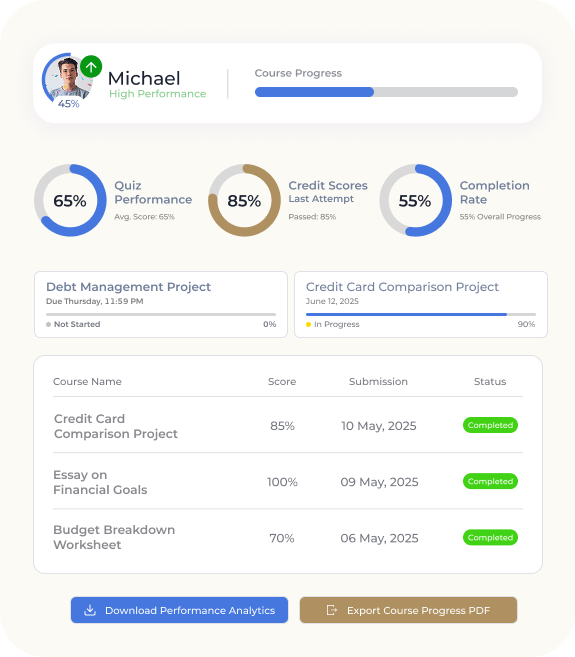

designed for teachers, loved by students

Customizable

Select any lesson from our catalog, use our test questions, guides, assignments - or not.

You choose, we provide.

Ready-to-Go

4k engaging videos, supportive summaries, test questions, reference guides, projects/homework: ready-to-go.

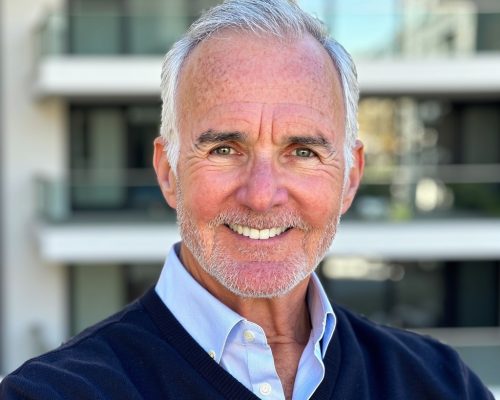

Expert-Led

Experts only. This way schools have confidence they're providing the best education and students get equal world-class education.

Engaging

Bite sized content, Emmy level editing, relatable, real-world examples, immediate to long term challenges - to name a few.

customize your classroom experience

Choose from our extensive catalog of pre-made lessons – each complete with media, reference guides, quizzes, homework assignments, and more. Need something specific? We’re happy to create custom lessons based on your needs.

Foundations (K-5)

Basics like “What Is Money?” and “Saving vs. Spending.”

- What is Money and Why Do We Use It?

- Saving vs. Spending: Making Smart Choices

- Where Does Money Come From? (Jobs and Earning)

- How Banks Keep Money Safe (FDIC Basics)

- Understanding a Piggy Bank vs. Savings Account

- Spending Money: Needs vs. Wants

- Plus many more fun, beginner-friendly lessons to build financial confidence.

Building Skills (6-8)

Topics like “Banking Basics” and “Understanding Credit.”

- Opening and Using a Bank Account

- How to Write a Check and Use a Debit Card

- Simple vs. Compound Interest Explained

- Basics of Borrowing: What is a Loan?

- Credit Scores: Why They Matter

- Protecting Your Money: Recognizing Scams and Fraud

- And more real-world skills to prepare students for smart money choices.

Life Ready (9-12)

Advanced lessons like “Taxes” and “Budgeting for College.”

- How to Budget for Your First Paycheck

- Understanding Credit Cards and Interest Rates

- Filling Out a FAFSA and Applying for Scholarships

- Basics of Investing: Stocks, Bonds, and Mutual Funds

- Building and Monitoring Your Credit Score

- Introduction to Taxes and Filing Basics

- Plus deeper lessons to ensure students graduate life-ready.

Advanced (Adult Learners)

In-depth topics like “Investing” and “Real Estate.

- Strategic Budgeting and Debt Reduction

- Advanced Credit Management and Repair

- Tax Planning Strategies for Working Adults

- Buying vs. Renting a Home: Financial Considerations

- Long-Term Investing: Retirement Accounts and College Funds

- Starting or Funding a Business: Loan Types and Requirements

- Along with extensive strategies for building wealth and financial independence.

see how we bring learning to life

Taught by industry experts, the content provided covers everything from banking basics and interest rates to money management, debt strategy, investing, and buying & selling a home.

from basics to mastery:

a full spectrum of financial literacy

LOREM